BLOG 20.05.2020

The Seven Trends to Partner Management Automation

by Peter O’Neill, Research Director Research In Action.

Are you ready for a new age of Partner Management Automation? I ask because, at the start of this year, I surveyed 1,500 users of Channel Marketing and Enablement (CME) software and talked to the most major vendors in that landscape. CME is those business processes involved for a manufacturer or vendor promoting products and services through partner (channel) organizations.

I was very expectant of this research … I’d assumed this market would be energized by a clear transformation in the relevance of channel strategy for modern businesses. For decades, it was just a peripheral process in most industries – “first we sell direct and then we’ll find some partners”. Which was fine for most firms: they were selling physical products (or at least on-premise software) and needed knowledgeable sellers to present and position the offer to buyers. The people responsible for the channel side of the business usually worked in their own silo, outside of the view of marketing or even sales management – not really a strategic role in the company even.

But now every industry is morphing to an “as-a-service” business model. And buyers pull the service based on their own research. But heh! channel partners are not being “dis-intermediated” – this was such a strange cliché back in the 1990s when the Internet took hold and everybody was writing about eBusiness and eCommerce taking work away from channel partners. If anything, partners are now even more influential and advocational for businesses. But the partner business model has changed too and they’re more than likely to live off revenues earned end-users than from manufacturers they now occasionally represent. And in addition to resellers or distributors, we now have channel players called affiliates, referrers, associations, communities, groups, ambassadors.

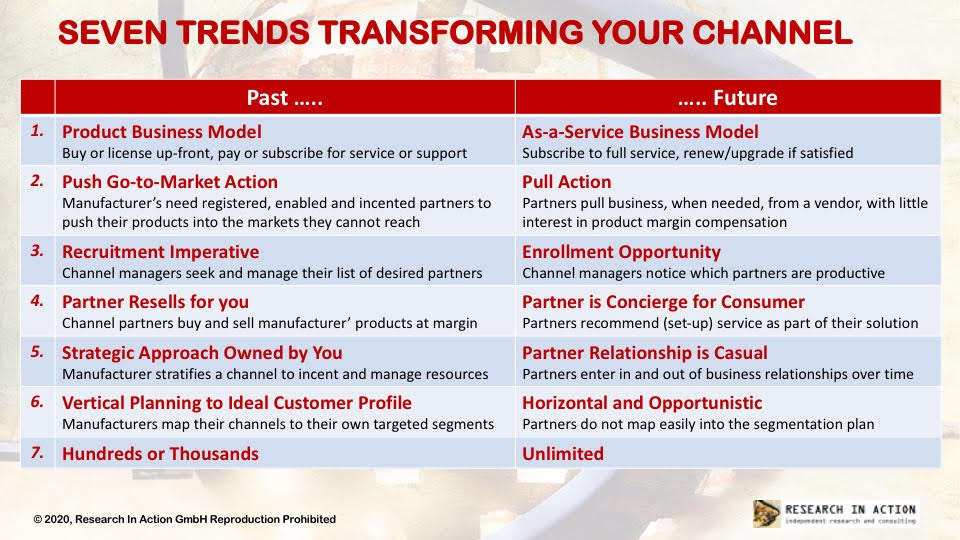

Below, I’ve described how I see this transformation under seven trend headlines. Over time, all these aspects of channel management are moving from the left-side state to the new or emerging state described in the corresponding right-side – allow me to propose calling this new state Partner Management Automation. (“Channel” often gets confused among marketers and, as we see in the table, not all partners are a channel anymore.)

The transformation has already hit the tech industry hard. Early last year, sitting on the top floor of Salesforce Tower in San Francisco, I reviewed the briefings I’d heard that day: Salesforce plans to work with perhaps 250,000 new partners in the near future? – it was the only way they can double their revenue in five years, they said. Now, they know that SaaS is not necessarily a reselling market – only around 30{9388bcb60c6488a42b9434699bbf55e32510a7f2522b97b882e05d0ad226590f} of SaaS revenues is booked by partners (compared to the old SW model of around 70{9388bcb60c6488a42b9434699bbf55e32510a7f2522b97b882e05d0ad226590f}) – but they still realize that their future success will depend on the recommendation and influence of many new intermediaries, most of whom the vendor will not even know or recruit formally as reseller partners. They will be lawyers, tax advisors, estate agents (realtors), financial and other types of advisers.

The Swiss software company VEEAM, who provide Cloud data management software and lead their industry segment, work through over 70,000 partners globally. They do not have hundreds of partner recruiters and managers to handle this volume, they must rely on a software platform to do that. And their channel enablement platform includes a concierge program in recognition of trend # 4 on this slide – the program provides relevant information to a concierge partner and also rewards that behavior.

And it’s not only the tech industry. When I talk to one of the global leading manufacturers of industrial bearings, Sheaffler Group here in Germany, they’ve found that their new sensor technology has created a whole set of new markets for them as an Internet-of-Things data provider – for example, the sensors they have installed in trains is now being combined with AI technology to provide important maintenance data about the railway tracks themselves which they can sell on to the Deutsche Bahn who maintain the infrastructure. Schaeffler continues to be a manufacturer and supplier but now also have a data service business through new partnerships. As-a-Service is happening everywhere.

Ultimately, when all of these trends have completed their cycle from left to right, manufacturers will need a much more holistic Partner Management Automation system to covers all of these scenarios. I say much more, because, till now, most channel software has been focused on just one or two of the family of processes under channel marketing and enablement.

In our survey, one question we asked of the 1,500 gave a clear marker – business buyers are now looking for a software platform that cover all of their needs regarding partners – marketing, management and even sales. But the current vendor landscape for this family of processes does not yet reflect this market need. Most of the vendors still focus on either channel marketing or enablement only. In my meetings with the vendors, my test question was “how do you handle affiliate partners then” and the response was mixed. The vendor landscape continues to be highly-fractured with deep specialization.

I am not confident that all of the vendors will be able to react to the disruptions described above — manufacturers seeking a channel platform that can support a highly-volatile partner community through a much more complete business cycle: from connection to order processing and service delivery. The vendors I found from the survey that do cover BOTH channel marketing and enablement are (listed alphabetically): Ansira, ChannelXperts, Impartner, TIE Kinetix, and Zift Solutions. I see only these vendors, plus the newer vendor Impact (mentioned but not with a sufficient number of respondents to be profiled), being able to cover the next generation channel management needs. Interestingly, Impact has already introduced the term Partnership Automation and talks about “automating the partner lifecycle” – a quite different perspective to how other vendors talk about their solution.

Anyway, when I survey the market again next year, I will be using the term Partner Management Automation to discover the appropriate vendor landscape.

Always keeping you informed!

Peter O’Neill