BLOG 09.06.2020

Mergers and acquisitions are shaping our 2nd half 2020 IT Automation Research Plan …Oh My!

by Eveline Oehrlich, Research Director Research In Action.

Baker McKenzie projected that technology merger and acquisition value will decline globally from $ 2.8 trillion in 2019 to $ 2.1 trillion in 2020[i] due to the current recession caused by COVID19. However, in some areas, the current recession has not slowed the mergers and acquisitions of some technology vendors. The rapid growth of Artificial Intelligence, Cloud Computing, Big Data and Cybersecurity is driving anticipated deal activity. Additional factors such as acquisition of talent and an extended reach into customers drives the buying of competitors and new technologies. Key acquisitions in the space of IT Automation have been driven by enterprise customer demands on productivity improvement within their teams and for their employees; the continuous acceleration of digital services which requires the IT team to provide better analytics; and the demand for quality and speed of software.

Productivity improvements include the leverage of bots to replace manual processes.

Manual processes are found in every business of today. Robotic Process Automation, a market which has experienced tremendous growth but also has stirred some debates about the replacement of workers, consists of a large set of vendors offering attended, unattended and hybrid bots that mimic human actions to complete repetitive tasks and processes. Acquisitions have shaped this market in 2019 and have continued in 2020 (and we are not done yet). Security requirements, improved licensing models, the central control of robots and the challenges of process knowledge has shaped the solution offerings across the vendors. The creation of smarter digital workers is critical for many enterprises as it allows the existing workforce to shift towards more creative and value add work across many industries. Adoption of process discovery and attended-mode RPA tools will allow for faster and higher quality process turnaround. Skeptics towards the agility and scalability and hesitations towards high implementation costs have been addressed by some of the vendors. Key acquisitions in this space are:

- Appian acquires RPA vendor Novayre Solutions[ii]. Appian offers low-code automation platform to accelerate the creation of business applications and is used by large enterprises. Low-code development enables the drawing of business logic, interfaces, rules, integrations, and all the other components that comprise an application. The low-code platform then takes that idea — the intention behind the new business app — and translates it instantly into working software. The acquisition of Novayre Solutions SL, the developer of the Jidoka RPA platform, adds RPA capability to Appians portfolio and creates an end-to-end process of software development supporting Appians vision is to have humans, software robots and AI all work together in a coordinated way enabling faster digital service delivery. Jidoka as the platform has strong unattended automation coupled with some attended capabilities. The company has already bundled RPA with its Appian Cloud solution.

- Microsoft acquires UK-based Softomotive[iii]. With its announcement of the acquisition of UK-based provider of robotic process automation software Softomotive, Microsoft has extended its automation capability specifically its desktop automation tool with Softomotive WinAutomation. Softomotive was founded in 2005 with headquarters in London, UK. The company received $ 25 million in Series A funding in September 2018 to expand sales, product development and professional services. In 2019 the company has doubled its headcount to more than 170 worldwide employees and currently has over 8,000 customers across the globe. Its automation offerings include desktop automation WinAutomation (standalone) which is a Windows-based software that allows for automation of routine and repetitive tasks on any desktop or any web-based application. Its RPA platform, ProcessRobot (server based) provides a scalable and secure way to automate processes in attended and unattended mode, distribute workload to robots, and tracks and assess their performance. WinAutomation and ProcessRobot share the same underlying engine for seamless transition, and support concurrency which enables multiple processes to run using a single license. Softomotive will be folded into Microsoft’s Power Automate platform.

For more details on our RPA Vendor Selection Matrix 2020 covering RPA vendors go here: http://researchinaction.de/wp-content/uploads/2020/04/RIA-VSM-RPA-2020-WWW.pdf

Acceleration of digital services requires IT teams to provide proactive intelligent analytics.

Digital Transformation must focus on customer experiences, service ecosystems, and resource integration as part of value cocreation. To support these transformations, IT operations must help their organizations meet evolving market demands of Digital Transformations through implementations of new technologies, development of new applications and migrations to the Cloud. However, the biggest challenge is eliminating issues which could impact the end customer negatively and this requires the presentation of relevant data and perspectives to functional groups so that they can work together preventing or solving issues across the ecosystem. This requires Big Data platforms which federate and synchronize data in a smart way with the goal to eliminate impact to the customer. Correlation, pattern matching, and other intelligent algorithms are applied to provide insight for further automated actions by either humans or digital agents. Key acquisitions in this space are:

- LogicMonitor acquired Unomaly[iv]. LogicMonitor traditionally has focused on IT infrastructure monitoring. The acquisition of Unomaly in January 2020 shifts LogicMonitor into the AIOps space competing with vendors such as Datadog, Dynatrace, NewRelic, Moogsoft and others. Unomaly has patented technology and operationalized machine learning algorithms which automatically surface unexpected events, missing parameters or frequent or suspicious repetitive entries to accelerate identification and resolution of IT issues.

- ServiceNow acquired Loom Systems[v]. The struggle to meet the performance expectations around new and existing digital services is huge for IT departments. ServiceNow which has focused on the automation of work is bringing together Loom Systems’ ability to analyze log and metrics data with ServiceNow’s AIOps and workflow automation capabilities. This will allow IT departments to proactively pinpoint and resolve operational issues, enabling improved digital experiences for their customers and employees. Loom Systems patented logging, collecting and parsing of data solution for on-premise and in the Cloud applications knows how to classify performance issues automatically. No data preparation is necessary for the ingestion nor any manual configuration of thresholds or manual recalibration is needed as these are set automatically based on a unique signature and are adjusted as the environment changes. Its solution called Sophie AIOps automatically parses logs, detects IT incidents within any type of application by using AI and machine learning. This also will serve to advance ServiceNow’s increased commitment to accelerate AI innovation throughout its entire portfolio. Just recently they have created a new role of Chief AI Officer and brought on an Artificial Intelligence veteran to serve in this function.

For more details on our AIOps Vendor Selection Matrix 2019 covering AIOps vendors go here: http://researchinaction.de/wp-content/uploads/2019/07/RIA-VSM-AIOPS-GL-2019-07032019-website-2.pdf

DevOps Tool chain becomes critical for quality and speed of software delivery.

Enterprises of all types are demanding quality software delivery into production. This capability is critical for a successful digital business. However, as the development team proceeds with agile software delivery, the challenge is that some IT operations teams are unable to cope with this speed. The adoption of Application Release Orchestration can automate and improve the release cadence, improve quality and efficiency to accelerate innovation, support transformations and allow for efficient work between the responsible teams. IT enterprise teams today are either starting to adopt these automation tools or are looking to replace their existing tools. Key investment trends such as integration with testing tools, migration to SaaS platforms and the support of compliance regulations are driving the offerings of the existing vendors. While the vendor landscape is continuously changing with new entrants, mergers & acquisitions, new capabilities, and partnerships also shape the vendor landscape. Key acquisitions in this space are:

- XebiaLabs and CollabNet Agile DevOps Platform[vi]. In January of 2020, the investment company TPG announced that CollabNet VersionOne would be merging with XebiaLabs to create an integrated Agile DevOps platform. The two companies (plus Arxan which focuses on application security) have now been renamed to Digital.ai. With CollabNet VersionOne’s upstream, the Agile planning and version control capabilities together with the XebiaLabs’ downstream release orchestration and deployment automation functionality, the companies are well equipped to extend its leadership in the Agile DevOps platform world.

- BMC Software and Compuware combine to be a mainframe powerhouse[vii]. After announcing the definite agreement to purchase Compuware, a Thoma Bravo company and a leading provider of mainframe application development, delivery, and support solutions in March 2020, BMC and Compuware have just completed the merger. This combination will leverage BMC Automated Mainframe Intelligence (AMI) and the Compuware Topaz suite, ISPW technology, and classic product portfolios from Compuware to continue to modernize the mainframe industry as part of their combined DevOps strategies. The combined leadership team stated to help customers better manage their mainframe operations, cybersecurity, application development, data, and storage as part of their enterprise DevOps strategies. Additionally, the company will seamless integration of the mainframe platform development and management processes into the enterprise technology stack. The mainframe is part of meeting the worlds changing digital business needs, enterprise customers are embracing new mainframe capabilities and develop their staff to continue the platform and baby boomers and millennials both see benefits of the mainframe of today [viii].

For more details on our coverage of DevOps tools see our 2020 covering Application Release Optimization vendors go here: http://researchinaction.de/wp-content/uploads/2020/01/RIA-VSM-ARO-2020-WWW.pdf

Our 2020 2nd half research agenda for IT Automation is ready

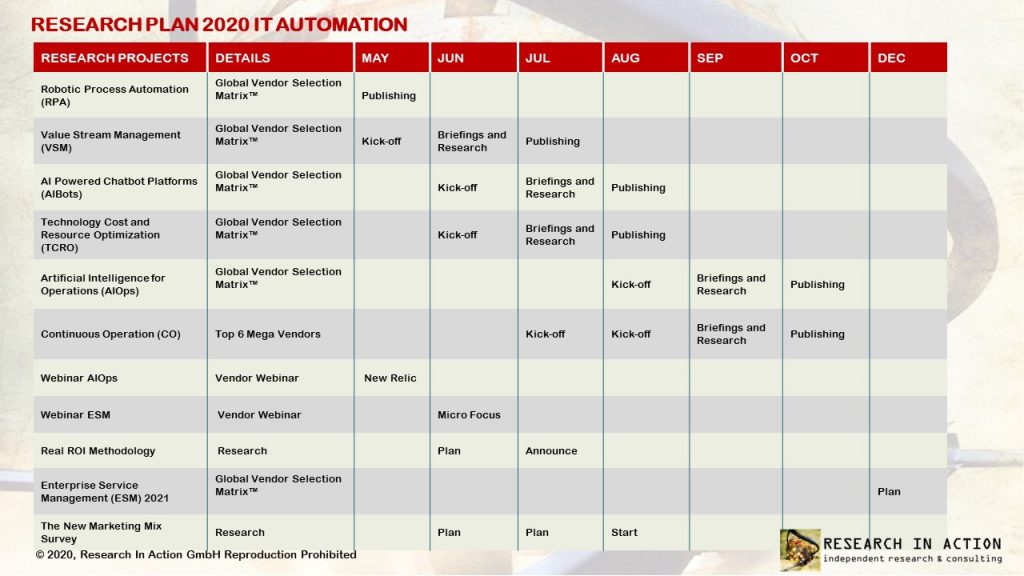

IT leaders are rethinking their spending priorities considering the pandemic and its impacts[ix]. One clear conclusion is that the pandemic is actually accelerating Digital Transformation efforts. This has led us to update our research agenda on across the topics of IT Automation for the second half of 2020. We do anticipate that the demand for solutions across topics such as DevOps (which includes Value Stream Management), Artificial Intelligence (which includes AI Powered Chatbot Platforms and AIOps) will be important to dive into and evaluate the vendors. Also, acquisitions such as that of Compuware by BMC has inspired us to evaluate the mega vendors in the Continuous Operation space. This space which encompasses the management and monitoring of the hybrid environment supporting and enabling Digital Transformations is going to be critical.

Here is our research agenda for the second half of 2020 covering key topics in IT Automation:

For more information go here: 2020 IT Automation Research Plan

Greetings

Eveline Oehrlich

________________________________________________________________________________________________

[1] https://www.bakermckenzie.com/en/newsroom/2019/10/global-transactions-forecast-2020

[4] https://www.logicmonitor.com/blog/logicmonitor-buys-swedish-it-monitoring-firm-unomaly

[5 https://www.servicenow.com/company/media/press-room/servicenow-to-acquire-loom-systems.html

[8] http://documents.bmc.com/products/documents/94/30/519430/519430.pdf